Introduction to Tax Deductions for Truck Drivers

As we enter the 2023 tax year, it’s more important than ever for truck drivers to understand their IRS tax deductions. This guide simplifies the key deductions, helping you make the most of your finances.

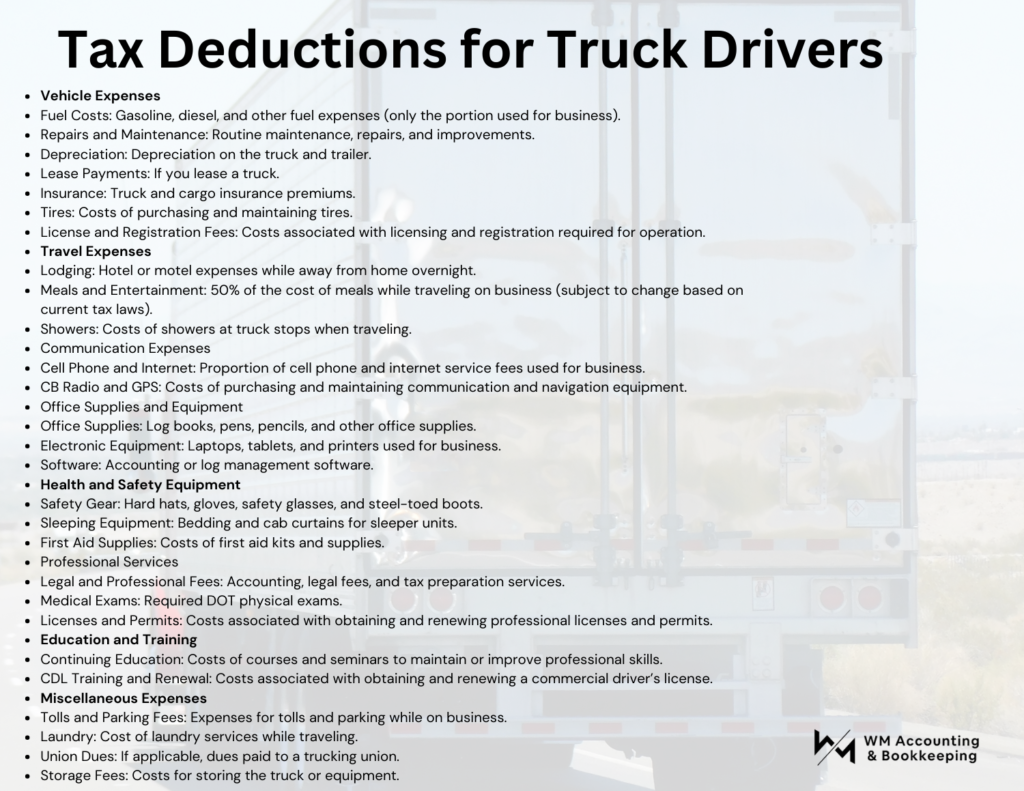

Key Tax Deductions Explained:

- Daily Expenses (Per Diem) and Fuel Costs: Truck drivers can use per diem deductions for nights spent away from home, covering meals and incidental costs. Additionally, fuel and maintenance costs are deductible. Keeping up to date with IRS rates and maintaining thorough records of your expenses is essential.

- Vehicle and Equipment Deductions: You can deduct the depreciation of your truck and equipment. This is particularly significant for those who own their trucks. Accurate record-keeping for the purchase price and any improvements is crucial.

- Home Office and Professional Fees: If you have a dedicated home office space, you may be eligible for deductions related to rent or mortgage, utilities, and insurance. Also, expenses for obtaining and maintaining licenses, like your Commercial Driver’s License (CDL), are deductible.

- Professional Development and Health Insurance: Costs for industry training and educational materials can be deducted, emphasizing the importance of professional growth. For self-employed truck drivers, health insurance premiums may also be deductible.

- Communication Costs: Expenses for business-related communication, such as cell phone and internet usage, are deductible. Keeping detailed records is important to claim these expenses.

Download our Tax Deductions for Truck Drivers Checklist

Conclusion: Maximizing Your Tax Deductions

Navigating tax deductions is vital for truck drivers in 2023. Proper record-keeping and understanding of deductions can significantly impact your financial health. Tax laws are complex, so consulting with a tax professional is recommended to ensure full advantage of all applicable deductions. This guide serves as a starting point, with insights into potential changes and strategies for maintaining financial health amid evolving tax regulations. Contact WM Accounting & Bookkeeping for more information.